how do you calculate cash flow to creditors

B Beginning Long Term Debt. Net new borrowing asks for ending.

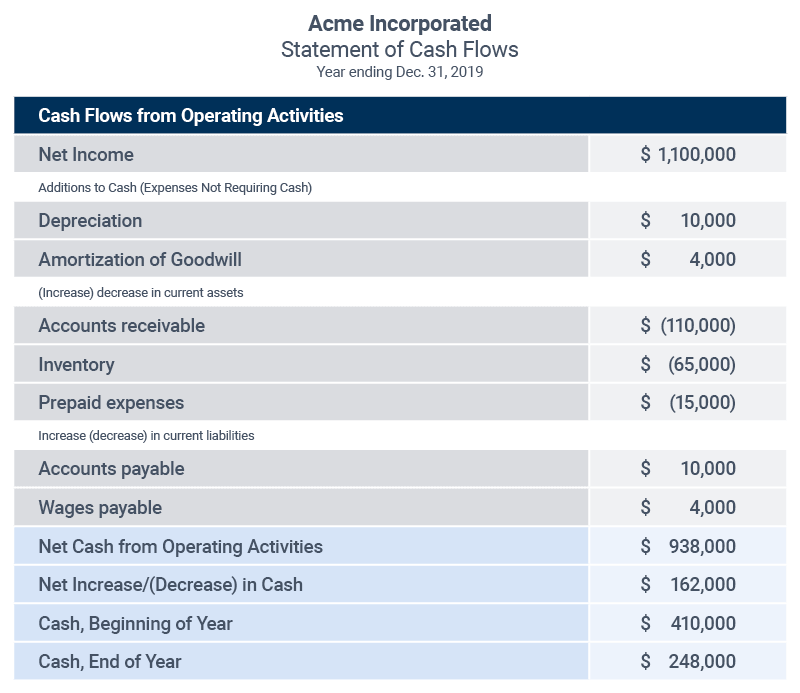

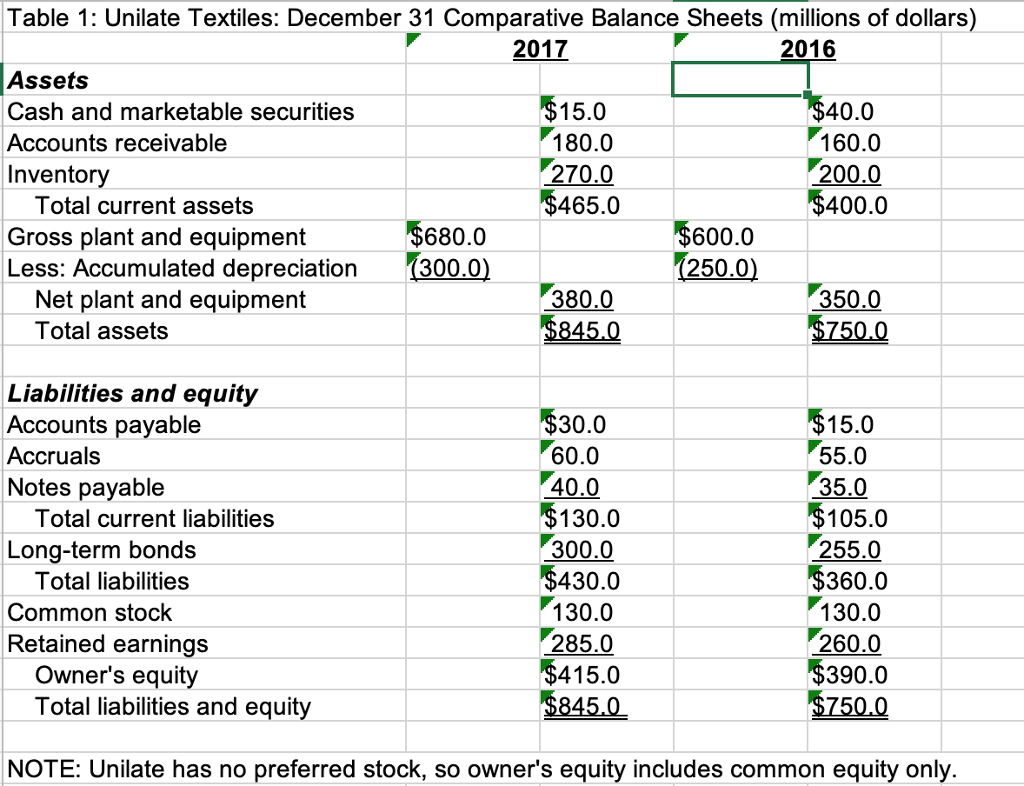

Net Cash Flow Formula Step By Step Calculation With Examples

When Does Cash Flow To Creditors Increase.

. Find The MT Bank Cash Management Solutions To Fit Your Financial Needs. There are two different methods that can be used to. Heres how to calculate available cash flow.

Created By Our Financial Experts. Equation for calculate cash flow to creditors is Cash Flow to Creditors I - E B. While the exact formula will be different for every company depending on the items they have on their income statement and balance sheet there is a generic cash flow from.

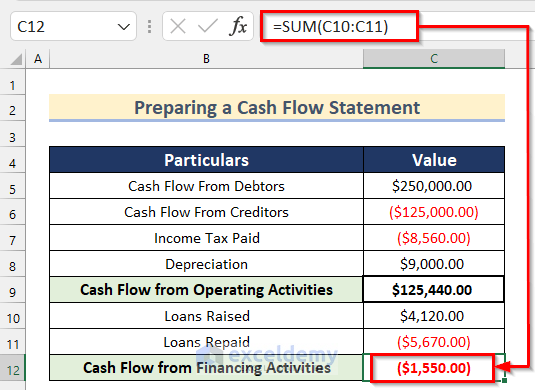

E Ending Long Term Debt. Operating Cash Flow Net Income All Non-Cash Expenses Net Increase in Working Capital. Enter the total interest paid ending long-term debt and beginning long-term debt into the calculator to determine the cash flow to creditors.

Forecasted Ending Cash Beginning Cash Projected Incoming Cash Projected Outgoing Cash. Where I Interest Paid. Where I Interest Paid E Ending Long Term Debt B Beginning Long Term Debt.

Creditors interest paid net new borrowing. How do you calculate cash flow to creditors if you are not given long term debt. Cash flow is the measure of total amount of liquid cash that is moving in and out of the business.

Ad Business advisors CFOs at companies of every size industry rely on Fathomtry it free. Cash Flow to Stockholders. Get insightful reporting fast cash flow forecasting and actionable financial insights.

Creating cash flow statements. Get a Cash Flow Statement Template. Download Print in Minutes.

Cash Flow to Creditors I - E B. Since so many transactions involve non-cash items you have to alter how you calculate their effect on cash flow. This is a lot easier to calculate than it sounds.

When a company pays all its debt in cash form and not any other liquid asset it increases the cash flow to the creditors. The items in the cash flow statement are not all actual cash flows but reasons why cash flow is different. Ad Customized Cash Flow Management Solutions From MT Bank.

The following formula is used to calculate the cash flow to creditors. Just look at the amount of money that you are owed plus the amount of the debt you are in debt to the creditor. The formula of cash flow to.

Ad High-Quality Fill-in The Blanks Cash Flow Statement. Cash flow to creditors formula is derived as I E B where I Interest Paid E. The simple formula above can be built on to include many different items that.

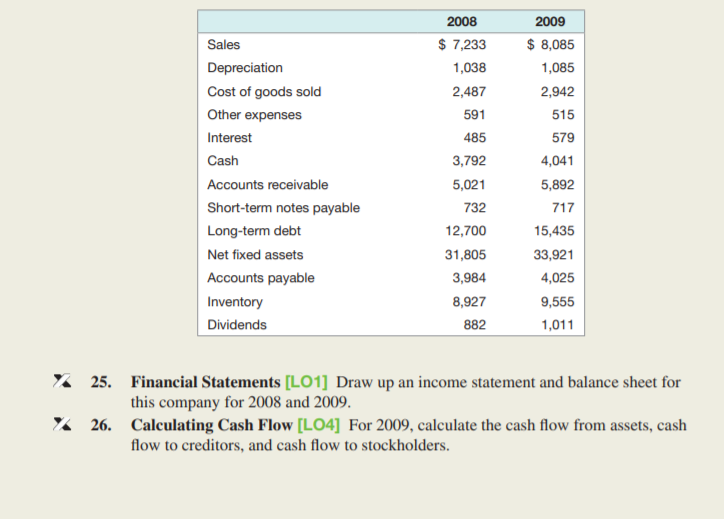

Solved Problem 2 23 Calculating Cash Flow Use The Following Chegg Com

/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)

Corporate Cash Flow Understanding The Essentials

How To Calculate Net Cash Flow In Excel 3 Suitable Examples

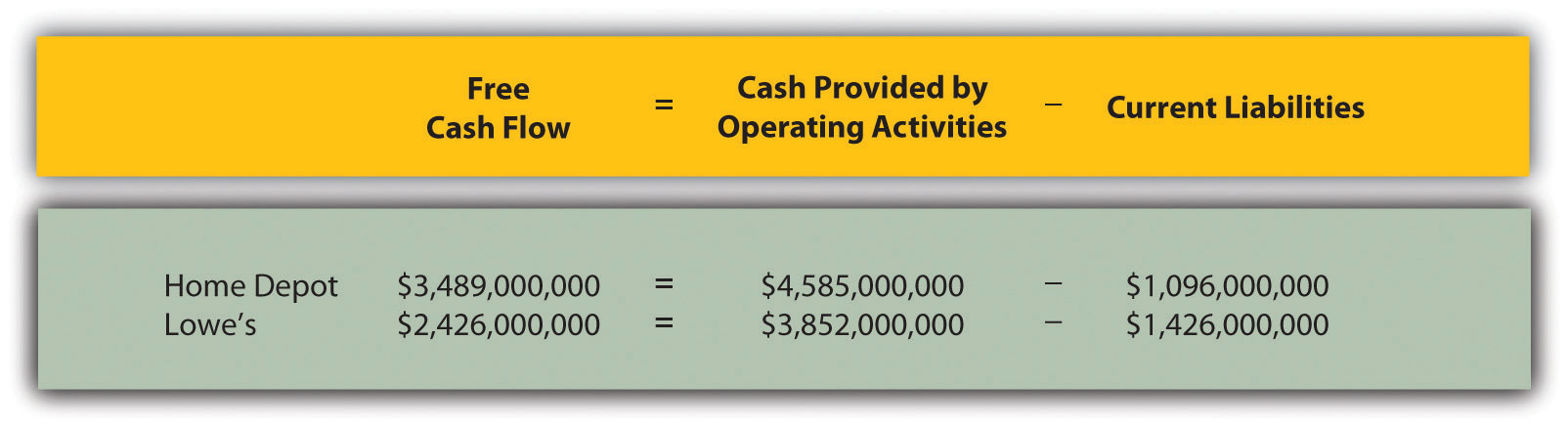

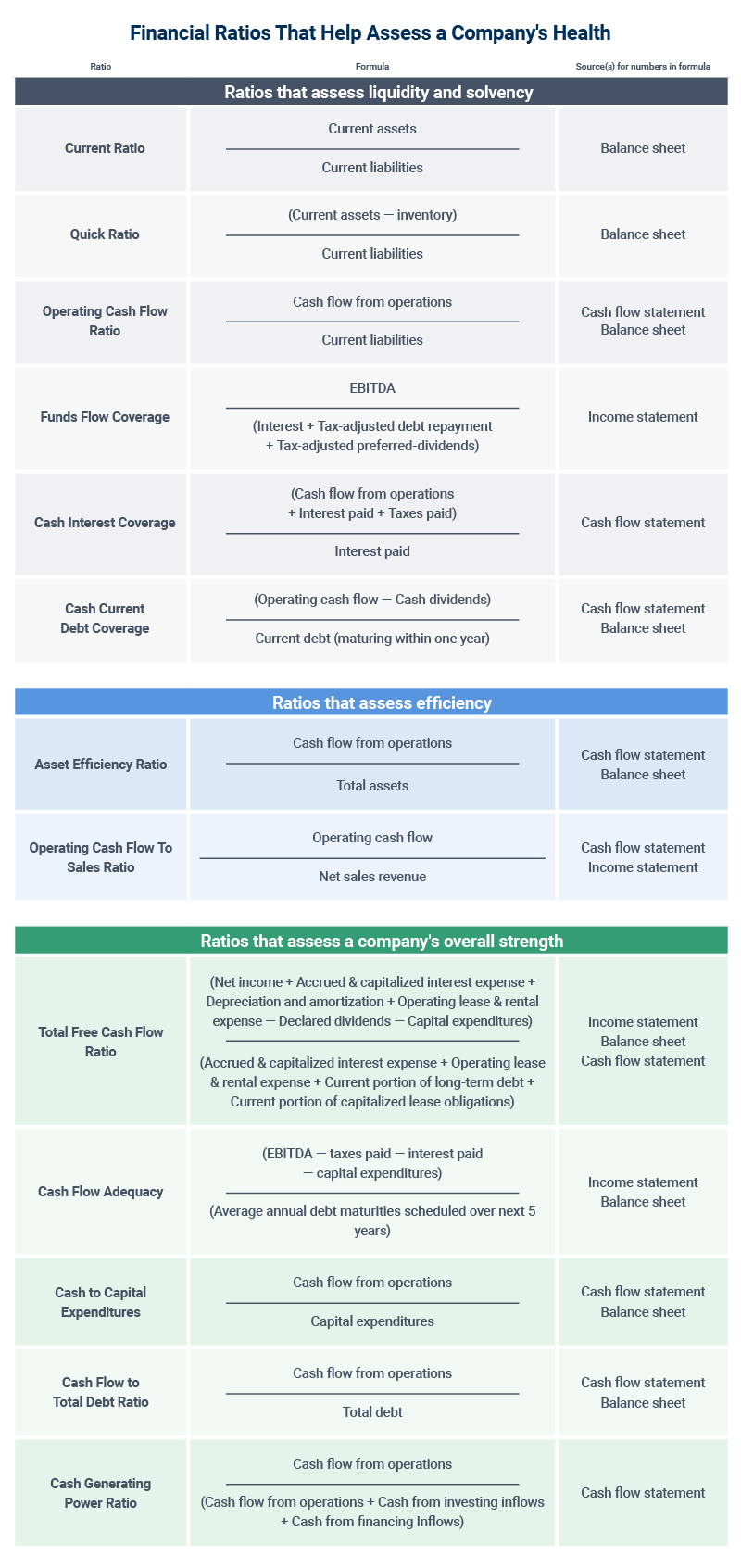

Analyzing Cash Flow Information

Operating Cash Flow Basics Smartsheet

/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)

Cash Flow Statements Reviewing Cash Flow From Operations

Solved Use The Following Information For Taco Swell Inc Chegg Com

Solved Problem 2 22 Calculating Cash Flow L04 Use The Chegg Com

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

Cash Flow Statement Analyzing Financing Activities

Cash Flow From Assets Definition And Formula Bookstime

Calculate Cash Flow Creditors Ppt Powerpoint Presentation Infographics Graphic Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

Answered 2008 2009 Sales 7 233 8 085 Bartleby

Cash Flow Definition Uses And How To Calculate Nerdwallet

How To Prepare A Cash Flow Statement Hbs Online

Operating Cash Flow Basics Smartsheet

Solved Calculate The Cash Flow From Assets Cash Flow To Chegg Com

:max_bytes(150000):strip_icc()/Term-Definitions_freecashflow_FINAL-ebecf2a8576047c0a8b9446f29b63b71.png)